Top 5 things to keep in mind while financing my solar system

A solar system could potentially save a significant amount on your electricity bills every month plus this investment can increase your property value and also save the environment.

Generally, solar systems pay off their initial investment within 6-10 years.

If you employ the savings from your solar power project to offset the cost of your electric bill, you’ll find yourself paying less than what you would have paid using traditional means! There is a spread of financing options available for solar power panels like loans, net metering agreements with utilities, leasing options, and grants.

1. Check your credit score – Credit score is the important eligibility criterion for solar panel financing. This generally requires a Credit score of 660 or higher to qualify for solar financing. It helps to avail loans with low-interest rates.

2. Consider a loan – you’ll obtain a loan to purchase a solar power system. Loan options, including zero-down financing. There are several sorts of loans:

Personal loans –

Personal loans for solar systems are getting popular. It offers fixed interest rates and monthly payments, so you usually know how much you’re paying. There are short-term (12-18 months) loans, also called bridge loans, that allow you to use the ITC and state credits immediately rather than waiting until you file taxes. In fact, you’ll combine this short-term with a long-term loan that covers the remaining cost of your installation.

Home Equity Loans –

It works as a home loan, but they allow you to borrow against your home as collateral. Monthly payments depend on the borrowed amount. With a home equity loan, you’ll get approval even with a poor credit score as this is a secured loan and borrow only a part of the credit limit as per your need. The interest is charged only on the borrowed amount.

3. Documents required for solar financing – the below documents are needed while financing solar power panels.

● Power purchase contract (PPA)

● Residence & Factory ownership proof

● Proforma Invoice / Quotation

● Quality and safety standards followed

● List of authorizations and compliance gained

4. Other solar financing options –

Remember that private loans are not the only option for financing a solar system. There are many options, so explore all the options before making a decision.

EMI payments – Buying solar energy using a credit or debit card to access the EMI options for most loans including solar systems.

Home improvement loans – you can avail of home improvement loans for upgrading or improving the property. Banks like SBI offer pans up to 1 lakh for home improvement and you’ll get such loans to set up a solar system.

Lease – Like leasing a car, you’ll lease a solar energy system to reduce your upfront expenses. Under this arrangement, a solar installer, finance provider, or other third party owns and maintains the system you set on your roof. you’ll pay a fixed monthly rate to the company that owns the system. A lease is usually 20-25 years.

Power purchase contract (PPA) – This is also like a lease. The difference is what proportion you pay and to whom. Under this, you buy the electricity generated back from the system owner at a set rate per kilowatt-hour. With PPAs you’ll quickly see immediate monthly savings on your energy bill.

Note that if you lease or have a PPA, you’re not eligible for the tax benefits and incentives, but you’ll save money on energy in the long run and lower your carbon emissions.

5. Government solar financing Incentives

There are several things to keep in mind when financing your solar system. the govt offers tax benefits for solar panel installations, and lots of states offer additional rebates and incentives. These can make the system more affordable.

The Central Government and State Nodal Agencies offer subsidy schemes to the people for installing rooftop PV systems. There’s a 40% subsidy on benchmark capital costs for units of up to 3KW capacity and 20% for larger units up to 10 KW.

The electricity generated from the solar panels is employed for self-consumption with the net-metering approach. The buyer is charged for net units stored in the grid infrastructure for later use. This policy helps with the support of residential and C&I markets as well. The SRISTI scheme is in urban areas for the installation of solar panels. The SUABHAGYA scheme targets solar rooftop installations in rural areas where free electricity is given to all or any households irrespective of their APL and BPL status.

Renewable Energy Certificates (RECs)- These are tradable certificates that are meant to offer benefits to the ones who generate green power by providing incentives for every unit generated. It intends to supply advantages to the C&I sector for carbon neutrality.

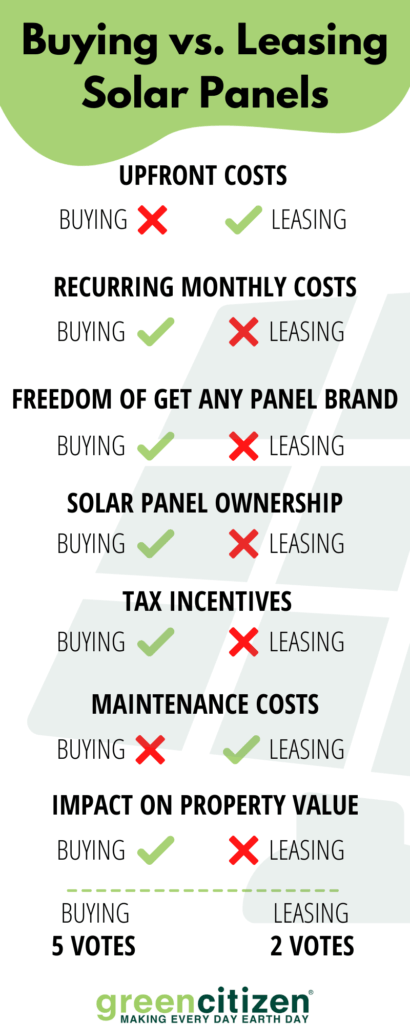

Buy or Lease???

Leasing solar panels make the switch to solar power more attainable for customers who may not have cash reserves. However, leasing solar energy panels means you do not own them. Rather, a 3rd party owns the equipment.

When you buy solar panels, there are often additional credits available to people that purchase solar panels based on the state or the manufacturer’s reimbursements.

Owning or leasing solar panels both allow homeowners to enjoy utility bill savings. Leasing is best if you want to get started with solar without a large initial investment while owning the solar panel is the best way to save money in the long term. it’s always important to explore and compare different offers before making a deal.

Conclusion

Solar systems typically have a payback period of 5-10 years. this suggests that you will be saving money every month, counting on the size of your system and the price of electricity in your area. By noting the above factors, you can be sure to get the best possible deal on financing your new solar system.

If you’re looking to purchase high-quality solar panels for your home with the best deals don’t forget to check out Goldisolar.com.